Travel nursing is an awesome adventure, but it also comes with unique challenges. One of the biggest is making sure you’re protected with liability and malpractice insurance. It’s like a safety net for your career.

In this post, we’ll break down everything you need to know about liability and malpractice insurance as a travel nurse. Looking for a travel nursing agency that has your back? AHS NurseStat offers fantastic travel nurse opportunities across America and provides professional liability/malpractice coverage when you join our team. Check out our current job openings.

Liability and Nursing

In the simplest terms, liability means being held responsible for something. In healthcare, it means you could be held accountable if a patient experiences harm or injury under your care. Nobody wants to think about that, but it’s a reality of the job, and it’s why having the right insurance is so important.

As a travel nurse, you might encounter several situations where liability could become a concern. Here are a few examples:

- Medication Errors: Accidentally administering the wrong medication or dosage can have serious consequences.

- Patient Falls: Patients, especially elderly ones, are at risk of falls, and you could be held liable if proper precautions weren’t taken.

- Documentation Errors: Accurate and complete documentation is crucial. Mistakes or omissions in your charting could lead to trouble.

- Negligence: This is a broad term, but it essentially means failing to provide the level of care a reasonable and prudent nurse would in a similar situation.

- Breach of Confidentiality: Protecting patient privacy is essential. Sharing sensitive information could result in legal action.

It’s important to remember that even the most skilled and compassionate nurses can make mistakes. Healthcare is complex, and things happen. Here’s a quick example: Imagine you’re a travel nurse in a busy ER. You’re rushing between patients and accidentally administer a medication to the wrong person. The patient has an adverse reaction and requires additional treatment. In this situation, you could be held liable for the error.

This is just one scenario, and there are many others. The point is that liability is a real concern for travel nurses. This is where malpractice insurance comes in to protect you. We’ll talk more about that in the next section.

Malpractice Insurance for Travel Nurses Across America

Malpractice insurance is a specialized type of insurance designed to protect healthcare professionals like you from financial ruin if you’re sued for malpractice. It’s a safety net that helps cover legal fees, settlements, and other expenses associated with a claim.

There are two main types of malpractice insurance:

Claims-made: This type of policy covers you only if the incident and the claim are made while the policy is active. This can be tricky for travel nurses who frequently change jobs. If a claim is filed after you’ve left a position and your policy has expired, you might not be covered.

Occurrence-based: This is the gold standard for travel nurses! An occurrence-based policy covers you for any incident that happened during the policy period, regardless of when the claim is filed. So even if you switch jobs or retire, you’re still protected for incidents that occurred while you were covered.

When choosing a malpractice insurance policy, pay close attention to these key features:

- Coverage Limits: This is the maximum amount the insurance company will pay for a claim. Higher limits provide more protection.

- Defense Costs: Legal battles can get expensive. Make sure your policy covers attorney fees, court costs, and other legal expenses.

- Tail Coverage: This is especially important for claims-made policies. “Tail coverage” extends your protection for a period after your policy expires, helping cover claims filed later.

- Licensing Board Defense: If your nursing license is ever questioned, this coverage helps with legal representation before your state’s nursing board.

Some agencies, like AHS NurseStat, offer malpractice insurance as part of their travel nurse benefits package. This can be a great perk! You can also purchase your own policy from a reputable insurance provider. No matter where you get your insurance, make sure you understand the coverage and choose a policy that meets your needs as a travel nurse across America.

What are the Specific Challenges of Travel Nursing?

Travel nursing is exciting, but let’s be honest, it also throws you some curveballs. You’re constantly adapting to new environments, working with different teams, and learning new policies and procedures. All of this can increase your risk of liability, so it’s crucial to be extra vigilant.

Here are a few unique challenges you face as a travel nurse:

- New environments, new rules: Every hospital has its own way of doing things. You’ll need to quickly get up to speed with their policies, procedures, and documentation systems.

- Unfamiliar equipment and staff: You might encounter equipment you’ve never used before or work with staff you don’t know. This can increase the risk of errors.

- Higher acuity: Some travel nurse assignments involve caring for patients with more complex or critical conditions, which can increase the potential for complications.

- Varying state laws: Nursing regulations and scope of practice can vary from state to state. Make sure you’re familiar with the specific laws in your assignment location.

So how can you minimize your risk? By being proactive and taking these precautions, you can significantly reduce your risk of liability and enjoy a safe and successful travel nursing experience. Here are some tips to keep in mind.

- Read the fine print: Carefully review your contract and the facility’s policies before starting your assignment.

- Communicate clearly: Maintain open and honest communication with patients, families, and colleagues.

- Follow best practices: Adhere to established nursing standards and guidelines.

- Document everything: Meticulous documentation is your best defense. Clearly document all assessments, interventions, and patient responses.

- Ask questions: If you’re unsure about something, don’t hesitate to ask for clarification. It’s always better to be safe than sorry.

- Know the Good Samaritan Laws: Familiarize yourself with your state’s Good Samaritan laws, which offer some protection when providing care in emergency situations.

Travel Nurse Across America – We’ve Got You Covered

AHS NurseStat is here to support you every step of the way. We offer incredible travel assignments across the country, competitive pay and benefits, and most importantly, we provide professional liability/malpractice insurance as part of our comprehensive package.

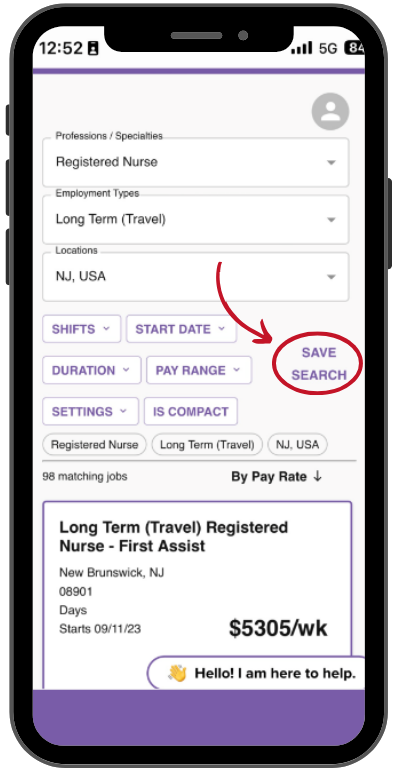

Browse open positions, learn more about our benefits, and discover why AHS NurseStat is the perfect partner for your travel nursing journey.