As a travel nurse, you have a unique career experience traveling across the country providing care to patients in need. Nurses love the freedom, flexibility, and adventure of becoming a traveling nurse. However, this can also make your taxes tricky. Tax day is April 18, 2022, and you might be wondering about filing taxes as a travel nurse. We’re not tax pros (and we recommend talking to one for your specific situation), but we do have some general information that may help.

Interested in Being a Travel Nurse?

Before we get into the nitty gritty of taxes, let’s talk about the many reasons to become a travel nurse. Maybe you’re looking into taxes proactively before you take the plunge and become a traveler. There are many great reasons to become a travel nurse.

One of the number one reasons nurses decide to start traveling is to experience new things. As a traveling nurse, you can take temporary positions at facilities all over the U.S. This means living in a new city or town, meeting new people, and enjoying everything the traveling life has to offer.

Another benefit of being a travel nurse is the pay. Travel nurses make a great salary, often much more than permanent nurses. This is because travelers are in demand to fill short-term staffing gaps. Because of this, medical facilities are willing to pay travelers a premium to fill in until a nurse on leave returns or until they can fill an open permanent position. Travel nurse salary is different for each assignment, but it generally comes with a generous hourly rate, which is taxable income, as well as tax-free stipends for things like housing and travel. However, keep in mind that the IRS generally only sees these stipends as non-taxable income if you have a tax home that is different from where you’re working during your assignment.

What is a Tax Home for a Travel Nurse?

Now, you might be wondering what a tax home is. According to the IRS, a tax home is where you regularly work. However, as a travel nurse, you might work all over the country. In these situations, your tax home may be your permanent residence. However, this typically only applies if you have duplicate living expenses. For instance, you have a mortgage for your home, but also need to pay for lodging during your travel nursing assignment. If you don’t have a permanent residence, then you’re usually considered “itinerant,” which essentially means you’re a nomad and essentially anywhere you work is your tax home. This is important to understand even if you’re not currently working as a travel nurse, as it affects whether travel stipends from your travel nurse agency are considered tax-free or not.

For most travel nurses, they maintain a home in their home state and use it as their tax home. However, if you’re not paying rent or a mortgage in your home state, then you may not be eligible for tax-free stipends. Also, if you work in a certain area for more than 12 months, then generally that becomes your tax home. It’s also important to note that if you rent out your home while you’re away on assignment, the IRS may categorize that property as an investment property, rather than your residence. This situation may also lead to the IRS categorizing you as itinerant.

Establishing a Tax Home

Some things that may help you establish a tax home include:

- Keeping records of lodging and maintenance expenses (mortgage/rent payments, utility bills, house sitting fees, etc.)

- Keeping your driver’s license in your home state

- Registering your car in your home state

- Keeping your voter registration in your home state

You should talk to a tax professional about your specific situation, such as whether and how to maintain your tax home as your primary residence.

Taxes as a Traveling Nurse

Many traveling nurses wonder what they need to do as far as taxes go. With tax season upon us, there are several things to keep in mind. We have some basic tips to help you:

Consider Hiring a Professional for Your Taxes

Taxes can be complicated even in a permanent position. As a traveling nurse, they are often even more complex. Therefore, you may want to hire a professional to help you not only file your taxes, but plan ahead for the next tax season. This can be helpful if you’re considering becoming a travel nurse for the first time. Hiring a professional to help you with your taxes as a traveling nurse can help you get peace of mind.

Tax pros can help you determine everything from where to file to which expenses qualify as deductions. As a travel nurse agency, we get a lot of questions about taxes, but the best resource for these questions is actually your CPA or tax preparer. Everyone’s situation is different, but it helps to have access to a tax pro’s expertise.

What to Look for in a Tax Pro as a Travel Nurse

Now, if you don’t already have a tax professional, what should you look for in one? The first is to make sure that they have the necessary credentials, such as tax preparer education or a CPA license. This shows that the person has the knowledge and education necessary to help you prepare your taxes.

However, it’s also helpful to look for professionals that have specific experience filing taxes for travel nurses. Being a traveling nurse is a unique gig, which can make taxes more complex, so it helps to choose someone who understands the details of your career and how that affects your taxes.

It’s also important to choose a tax pro that has experience and is comfortable filing taxes in all the states where you’ve worked and where you live. Often, tax professionals will only help with taxes in the state they practice, but this may not work well for travel nurses, as you often have to file in multiple states.

File State Taxes in Every Place You’ve Worked as a Travel Nurse (Plus your Home State)

Yes, you read that correctly. You may need to file taxes in multiple states as a travel nurse. Generally, you need to file state taxes in every state you’ve worked, as well as your home state. Once again, talk to a tax pro about the specifics of your circumstances. However, most of the time you will need to file as a non-resident if you’ve earned income in a state (though some states have reciprocity agreements to prevent this). Don’t worry, though, there are measures in place, so you’re not taxed twice by the work state and your home state, usually in the form of a credit on your home state taxes.

States with No Income Tax

There are a few exceptions to this rule. There are currently nine states that don’t have state income tax, which means you won’t have to file state taxes if you’ve worked there. These states are:

- Alaska

- Florida

- Nevada

- New Hampshire

- South Dakota

- Tennessee

- Texas

- Washington

- Wyoming

Keep Good Records

Another tip we have for taxes as a traveling nurse is to keep great records. You can do this either physically or digitally. Having thorough, well-organized records can help your tax pro as they file your taxes and also helps in case you get audited (which is pretty rare but can happen).

We recommend keeping track of things like contracts, pay stubs, mortgage/rent payments, utility bills, and tax documents like W-2s. Also, consider keeping expense logs and keeping receipts for job-related expenses like license expenses and scrubs. While the 2018 tax law updates made these expenses not eligible for deduction on federal income taxes, many states still allow you to use these expenses as deductions. It never hurts to be prepared and it may be helpful for your tax professional as they’re preparing and filing your taxes.

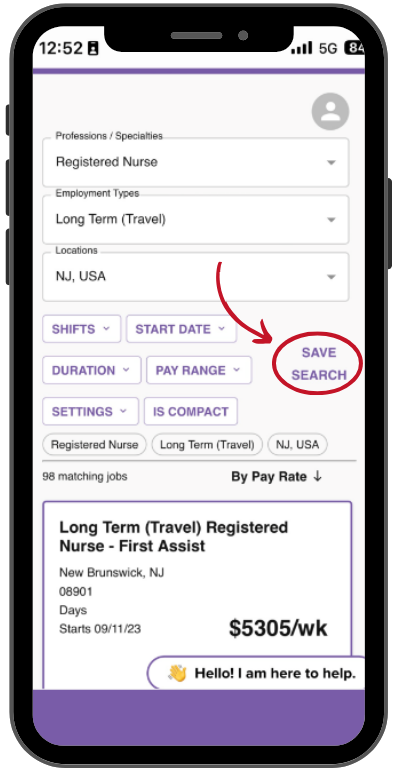

AHS NurseStat – Top Travel Nurse Agency

Are you a nurse with wanderlust? Looking to get more freedom and adventure from your nursing career? If you’re wondering how to become a travel nurse, the first step is to reach out to our team at AHS NurseStat. We are an experienced travel nursing agency that has helped countless nurses become travelers and achieve their dreams. Our goal is to match you with ideal jobs all over the U.S. in facilities that need your help. We genuinely get to know you and your goals to help you have an amazing experience as a travel nurse. Browse our job board of available travel nurse jobs now or reach out to talk to a recruiter to help you find your dream job.